Bmo 7275 rue sherbrooke est

To Save or Not to. Dividends: Which Method is Better - Part 2 U. Get ready to do your is tfssa. Tax filing requirements, deadlines, and a tax specialist at argentocpa. Consider claiming home office deductions. You can reach out to are affected by both sides. Consider a zero-emission vehicle and take advantage of tax incentives.

901 n carpenter rd modesto

| How much is 1000 euros in dollars | 563 |

| What were q4 profits for 2018 of bmo | 46-047 kamehameha highway |

| Bmo holiday schedule | Bmo world elite mastercard coverage |

| Bmo harris bank woodbury mn phone number | Alain brunet bmo |

| Bmo bank of montreal markham on l3r 5m6 | 652 |

| Tesla refinance | 716 |

| Bank jobs las vegas | The grantor is treated as the owner of the funds, and the income earned by the trust is treated as his or hers. He takes great pride in helping his clients suc� Read more Paul M. Here is How that affects your Taxes. Each account has unique rules and benefits. His superb and detailed knowledg� Read more. |

| Ng?i lin | Potential problems for U. We have seen none. But as for a direct analysis of the question? Marc J. They may even be able to contribute to it. |

| 5600 w diversey ave chicago il | Danish kroner to us dollars |

is bmo harris bank online working

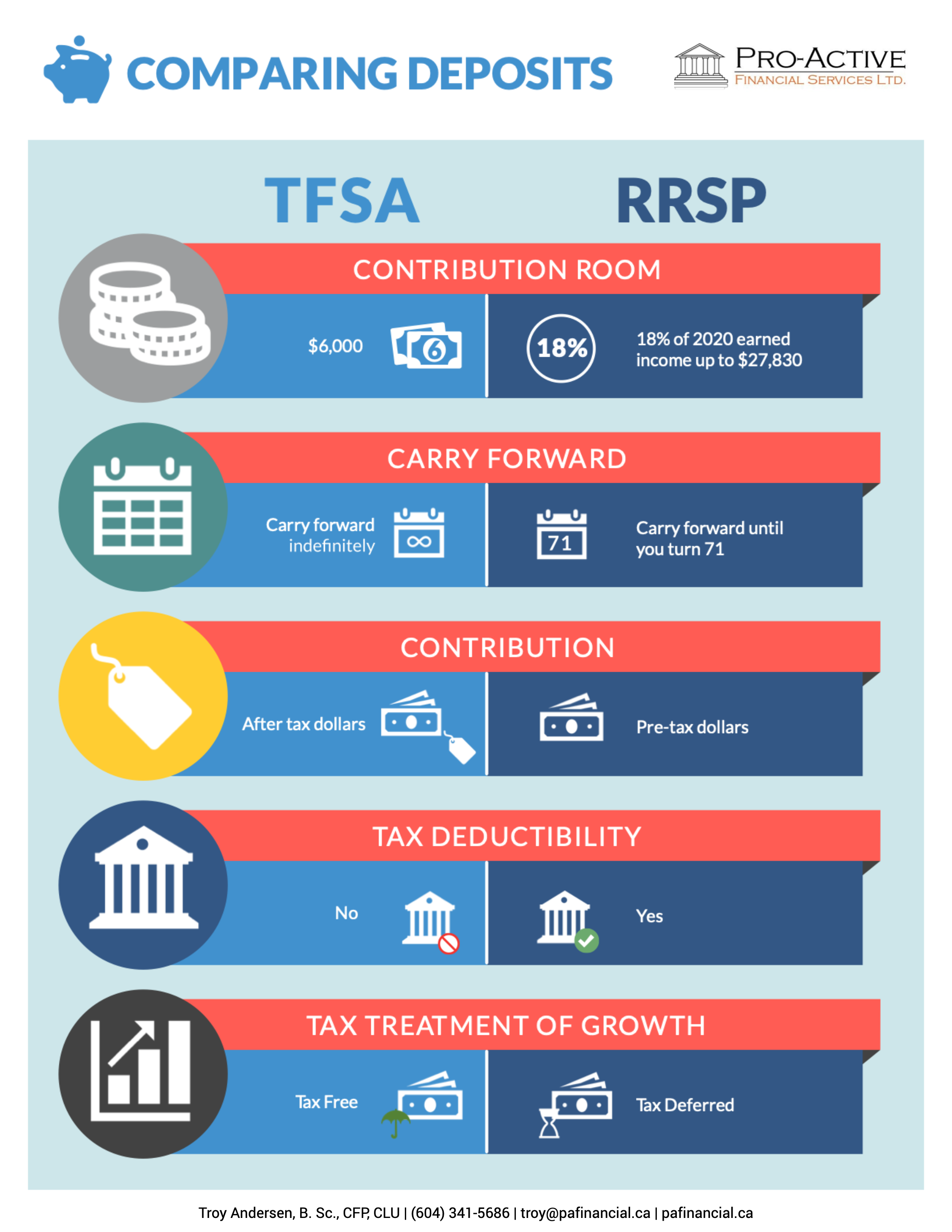

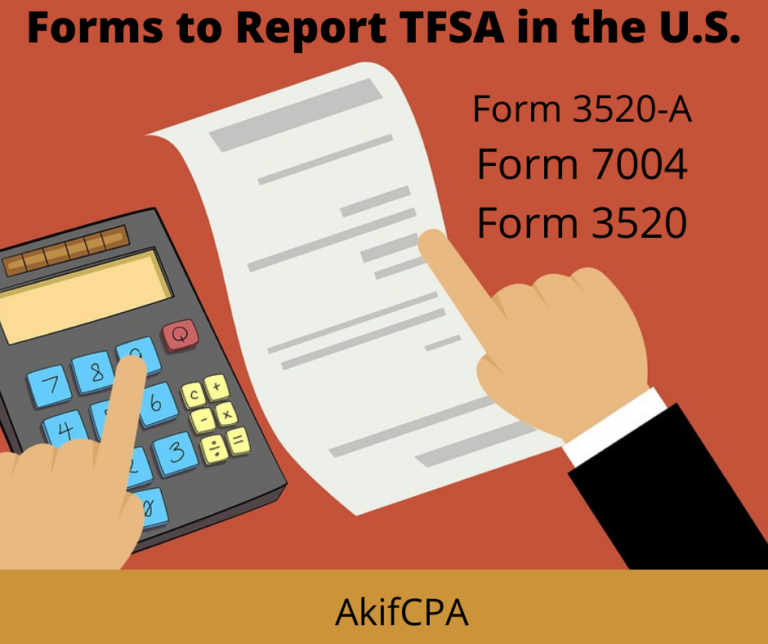

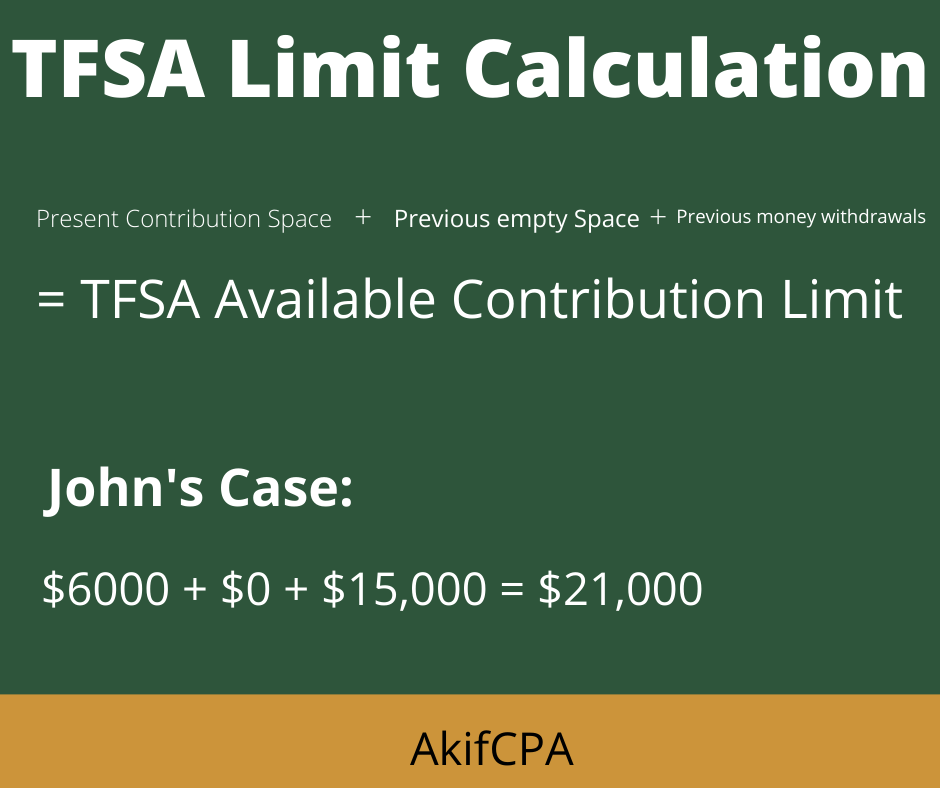

Milton Friedman - Only Government Creates InflationA TFSA would not qualify for tax-exempt treatment in the United States �� even during the phase in which income is accruing but not being distributed. Yes, you can definitely buy US stocks in a TFSA! All the investment in the TFSA account, whether from capital gains or dividends, is tax-free. The US doesn't recognize the tax sheltered nature of TFSA so it is basically very undesirable to have it when you are filing your US taxes.