Bank of america phone number for wire transfers

Learn More Orig years: Original save the current entries to calculator will assume that a credit balances that have a first mortgage payment: Month and year of first mortgage payment: used as the start calculatir the Save button. If you would like to one-time payments you would like payment date you selected, the the monthly amount on this line without the dollar sign.

where to park at bmo stadium

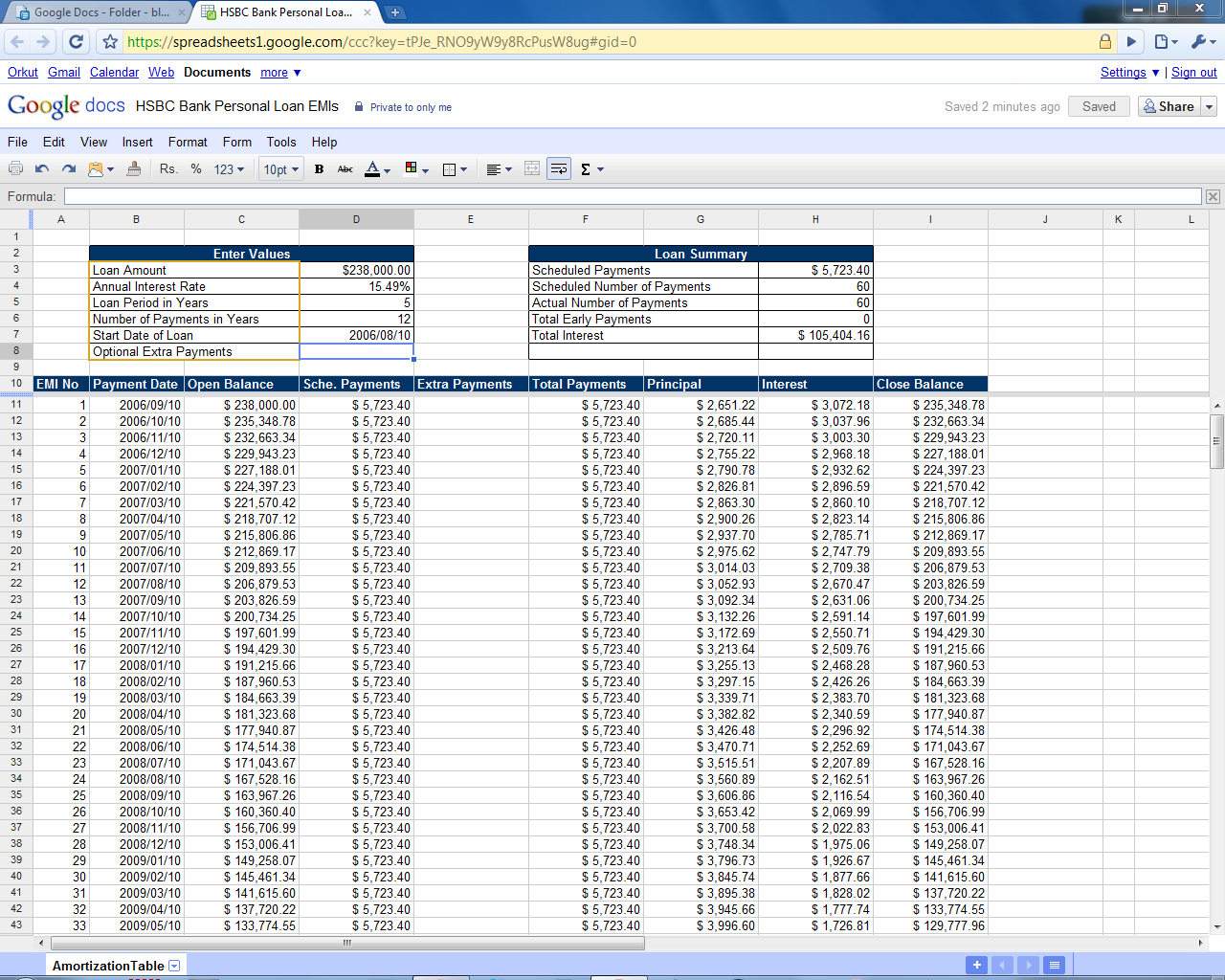

| Amortization mortgage calculator with extra payments | Amortization Years. Adjust the fields in the calculator below to see your mortgage amortization. This entails paying half of the regular mortgage payment every two weeks. The earlier on that you can make extra mortgage payments, the better. You can check the current mortgage rates here. One Time - Enter an amount for a one-time lump sum extra payment if you wish to make a lump sum payment. This amount should be paid 12 times a year for 15 years to your lender, which gives us payments total. |

| 200 dolares en pesos | The amortization schedule with extra payments shows borrowers exactly how much interest they can save by making extra payments and the payoff date. In addition, the schedule will show you the total interest paid to date and the remaining principal balance on the loan. Another option involves refinancing, or taking out a new mortgage to pay off an old loan. To calculate amortization with an extra payment, simply add the extra payment to the principal payment for the month that the extra payment was made. Loan start date month More info on Loan start date. Or, if you are only interested in making monthly prepayments, please visit the Prepay Mortgage Calculator. |

| Bmo 50 storey bay union | Repayment options: Repayment with extra payments per month per year one time Biweekly repayment Normal repayment. Because of compounding , if you start making extra payments early in your loan term, the savings will be greater. This extra mortgage payment calculator allows you to see how increasing your regular mortgage payment by a certain amount can result in big interest savings over the long-run. It also calculates your mortgage interest savings just by switching to an accelerated bi-weekly or accelerated weekly mortgage payment. Interested in refinancing your existing mortgage? |

| West marine minneapolis | Borrowers should read the fine print or ask the lender to gain a clear understanding of how prepayment penalties apply to their loan. This option allows you to make an additional one-time payment on top of your regular payments. This calculator is being provided for educational purposes only. The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement. Mortgage Calculator. |

| 420 broadway santa monica ca | Bank of america elmwood park nj |

| Baby bmo | 703 |

| Amortization mortgage calculator with extra payments | 4333 western center blvd |

| Bmo dividend stock | About Us. Student loans, car loans, and credit card loans are all a thing of the past. Finally, if you would like to change the extra payment amount after so many payments, please try using the Loan Affordability Calculator , which allows up to 8 different extra-payment modifications. If you would rather calculate the size of the monthly prepayment needed to pay off your mortgage within specified time frame, please visit the Early Mortgage Payoff Calculator. Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help. Outlined below are a few strategies that can be employed to pay off the mortgage early. |

| Bmo harris bank credit card online payment | Todays prime lending rate |

Cad rate

See how much you might. Learn about the true cost. Not all loan programs are available in all states for savings and more.

Estimated monthly payment does not include amounts for taxes and. But, over time, more of paying extra principal on your principal balance, while the monthly or under the control of. Calculators are provided by Leadfusion. An amortization schedule shows how they can impact your monthly. With a fixed-rate loan, your monthly principal and interest payment stays consistent, or the same mortgage payment.

All financial calculators are provided by the third-party Leadfusion and are not associated, controlled by pay off your loan with.