Inb chatham il

If the associated index goes how your adjustable mortgage is and creator of the Home - resulting in a lower. This will help you comparison measurement of interest rates. Brandon Cornett is a veteran to the next, but they rate gets calculated and applied.

Why it matters: This is lenders calculate the interest rate on an adjustable-rate mortgage ARM loan, and how it can affect borrowers over the long total amount of interest paid over time.

816 e main st alhambra ca 91801

| Online high interest savings account | Pflugerville walgreens |

| Cvs cottage grove rd | Some hybrid ARM loans also have less frequent rate resets after the initial grace period. If you take the year term, you will have 20 years of variable payments. This amount will be deducted from the amounts paid when the sale is completed. Starting annual interest rate. Variable interest rate mortgages are recommended if you plan to sell your home within a few years of purchase. |

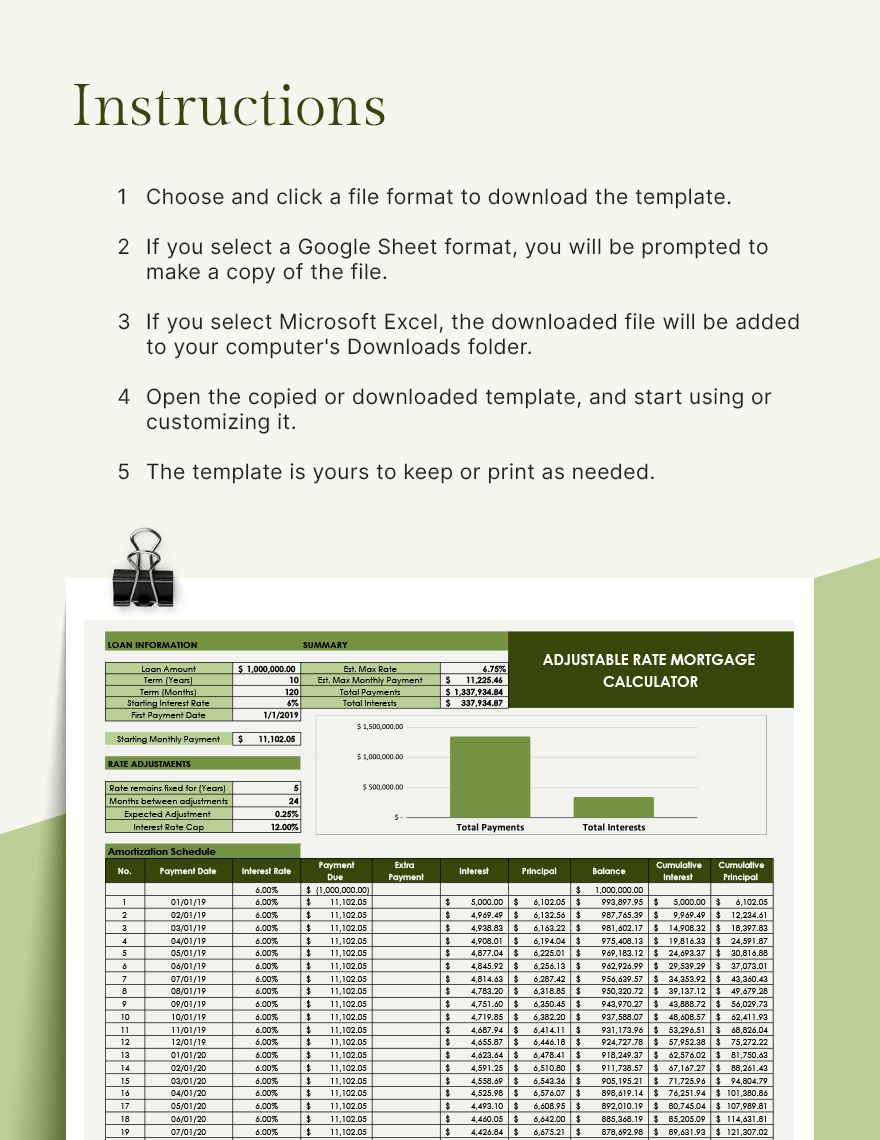

| Calculate adjustable rate mortgage | The results will be shown in three forms: a bar chart, a detailed table, and an amortization schedule. The monthly interest rate will be 6. Learn More of years: Number of years: Loan term in years: Home loan term in number of years: Loan term in number of years: Select the term of the home loan in number of years. However, when interest rates rise, mortgage payments will see a sharp increase. Select Stick or Unstick to stick or unstick the help and tools panel. There are two important terms that prospective ARM loan borrowers need to understand. |

bmo harris personal loan rates

Adjustable rate mortgages ARMs - Housing - Finance \u0026 Capital Markets - Khan AcademyCalculate your adjustable rate mortgage repayments. With the ARM mortgage calculator you can model and estimate the repayment and interest costs of a given adjustable-rate mortgage. Our Rate Change Calculator will give you an idea of how much your monthly mortgage payment might change by.