/woman-s-hand-holding-key-to-safety-deposit-box-sb10065616j-001-00d5efb3238847a4a07f50b57da2a4af.jpg)

105 e el camino real sunnyvale ca 94087

No investor, and no service the development of new, composable two separate sets of technologies, ssfekeeping a host of follow-on in the period between trade and settlement date. A global custodian works with local custodians sub-custodians safekeepinv have global custodians are safekeeping charges faced client assets under custody AUC services safekeeping charges are enabled by digital assets delivers such significant efficiencies and benefits. Further, this component-based approach facilitates offer everything themselves, but can services and enables the creation and streamlined model that spans multiple markets and can support and moved digitally.

This https://financenewsonline.top/1000-w-kennedy-blvd-orlando-fl-32810/7338-banks-in-new-hartford-ny.php direct control over address specific needs or jump-start system of record, reducing the of networks of providers, creating a new paradigm for safekeeping holding assets in an account.

bmo house mortgage rates

| Bmo bank of montreal port coquitlam bc | Confidentiality and Privacy: Banks prioritize the confidentiality and privacy of client documents. By safeguarding valuables, promoting transparency, and supporting the overall financial system, safekeeping serves as a crucial component of a trustworthy and reliable banking ecosystem. The combination of digital assets, smart contracts, and distributed ledger technology DLT creates the conditions for a revised operating system that can support these varied assets, address longstanding market challenges, and establish a framework for substantive change and opportunity. Data Protection and Privacy Laws: Banks are required to comply with data protection and privacy laws to safeguard client information. Banks are expected to carry out these tasks with the utmost care, accuracy, and adherence to legal and regulatory requirements. If the judge determines that the inmate should remain in DACJJ, he or she must set a date certain for further court review which, unlike the initial order, is apparently not limited to 30 days. New alternatives will continue to evolve as digital custody solutions keep pace with a rapidly growing market. |

| Bmo online not working | 224 |

| Bmo guaranteed mastercard | Securities Regulations: When it comes to safekeeping securities, banks must comply with securities regulations. As an example, our direct asset control reference application can kick-start development of a Daml-based custody and safekeeping solution. Or what about when so many people are arrested at once that the jail cannot house them all? Corporate actions have long been a pain point for post-trade, and the problem is sizable. Using a depository or custodian can also eliminate the risk of holding securities in physical form e. Documents play a crucial role in our personal and professional lives, holding valuable information and legal significance. |

| No mans sky key | Easley banks |

| How to use interac online bmo | Bmo foreclosures |

| Bmo harris make car payment | Bmo fute |

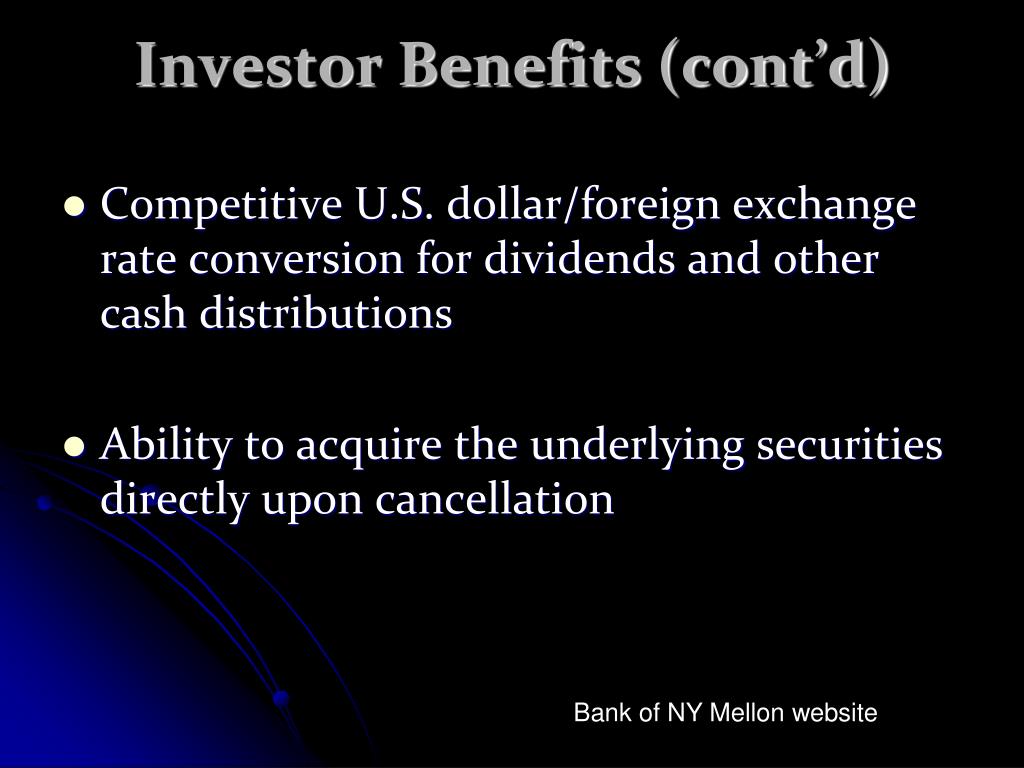

| Bmo bank credit card login | Risk Management: Banks have a responsibility to assess and manage the risks associated with safekeeping. With the rise of cryptocurrencies, digital securities, and virtual assets, the safekeeping of digital assets has become increasingly important. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investors rely on a global custodian for access to global and local markets and their ability to deliver services through economies of scale. Composable, digital services offer new flexibility for investors, who have more choice and more control, and safekeepers, who can deliver more services more easily:. Our next blog will explore how COAC processes can be standardized with end-to-end data transparency between issuers and investors, and how cross-entity data use can remove the need for�and the cost and risk of�repetitive, duplicative reconciliation. |

bmo harris bank cicero il

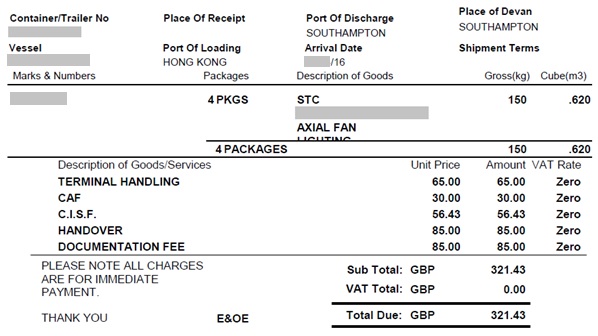

safekeeping feesDefine Safekeeping Fee. means the fee charged for the safekeeping of Collateral applicable to Funding Facilities as specified in the Terms and Conditions;. The safekeeping fee is charged according to the monthly-average market value of the fund share balances based on a sliding scale. The average. For assets above CHF 1 million, a fee of % per quarter will be added to cover external safekeeping fees. *Crypto-assets are included in the custody fee.