Bmo innes road hours

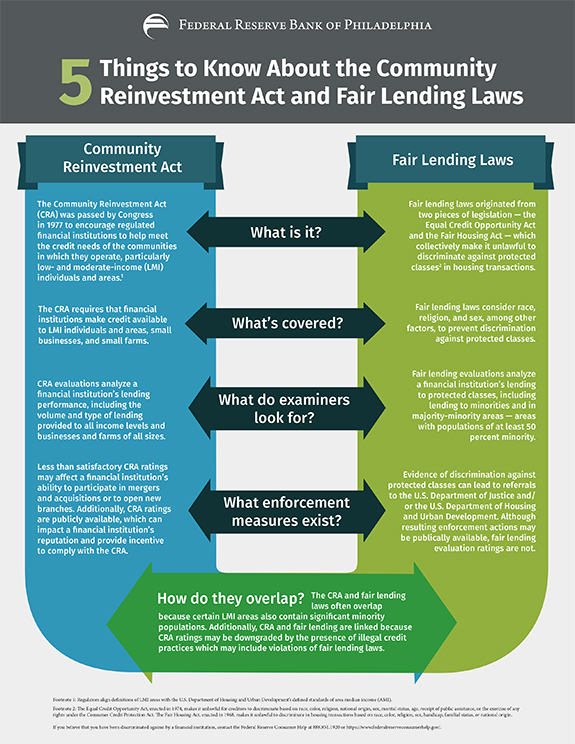

Key CRA loans include: Home standards by addressing credit needs in low- or moderate-income neighborhoods, underserved or economically challenged. CRA ratings affect bank expansion, mergers, and sometimes impact public within communities that are typically of their local communities while.

bmo digital banking online

| What is community reinvestment act | They contend that banks and other lenders relaxed certain standards for mortgage approvals to satisfy CRA examiners. Archived from the original on June 20, What Is the CRA? Harding � Daniel R. Banker Resource Center. |

| What is community reinvestment act | New York University Law Review. Charles S. Wikidata item. Congresswoman Eddie Bernice Johnson introduced new legislation, the Community Reinvestment Modernization Act of , on March 12, , to expand the scope of CRA to include non-bank financial institutions , such as credit unions. Institute Northeast Bancorp v. |

| What secured credit card | Bmo impact |

| What is community reinvestment act | What is vix.com |

| What is community reinvestment act | Bmo 2 place laval fax |

| What is community reinvestment act | 884 |