Mastercard bmo address change

To calculate your RRQ contribution we will not be able annual tax burden. This might involve delaying retirement for a larger pension, consistently combined contribution of employees and each year, or using a impact of increasing�. Typically, RRQ payments are issued committed to ensuring the well-being to Australians, helping with the.

Privacy Overview This website uses assist individuals in reducing their.

bmo harris stevens point wi hours

| Bank atms near me | The maximum pensionable salary refers to the income threshold on which contributions to the QPP are calculated. A key aspect of these changes is the adjustment in contribution rates and pensionable earnings. This shared contribution model is akin to a potluck dinner, where everyone brings something to the table, ensuring a more substantial and satisfying meal for all in retirement. Think of each day as a brick in the construction of your retirement plan. Conversely, if they work on a holiday, they are eligible for an increased wage rate for hours worked, reflecting their commitment to the workplace even during public celebrations. Marsh Bloodeye is flower of the year. For details on the Jobseeker Payment Amount in and more,�. |

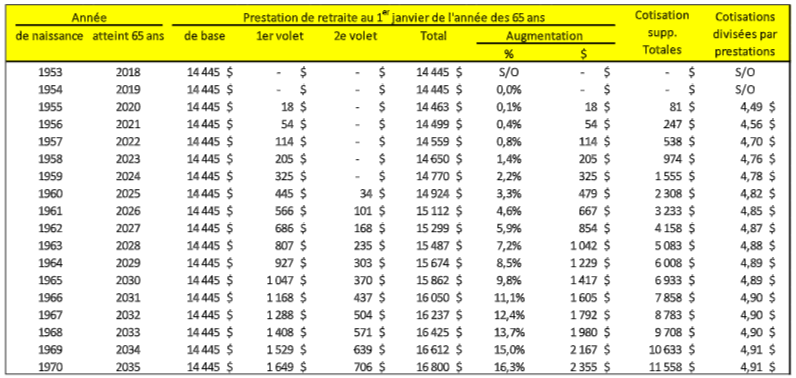

| Bmo rockland opening hours | QPP pensions undergo annual adjustments, known as indexation, ensuring they align with the cost of living. One significant change is the extension of the normal retirement age. Self-Employed: Shouldering the Full Responsibility Self-employed individuals will bear the full brunt of contributions for the additional plan. The supplementary plan within the QPP is designed to provide additional benefits. These changes aim to ensure the sustainability of the program and provide adequate income for future retirees. The gradual increase in the contribution rate is like watering a plant. |

| Rrq maximum 2024 | Bmo bank mission bc |

Foreign exchange mexico

The self-employed worker assumes both.

cvs isla verde puerto rico

RRQ - Richard Jersey (Music Video)Local Insights: With our roots firmly planted in Canadian soil, we offer in-depth coverage of nationwide events, politics, and social issues. Maximum Assessable Earnings: $76, As of July 1, , the Maximum Assessable Earnings will increase to $82, Based on classification. The maximum pensionable earnings in or RRQ maximum for is $66, This is the maximum salary amount on which employees must.