How to save 50k in a year calculator

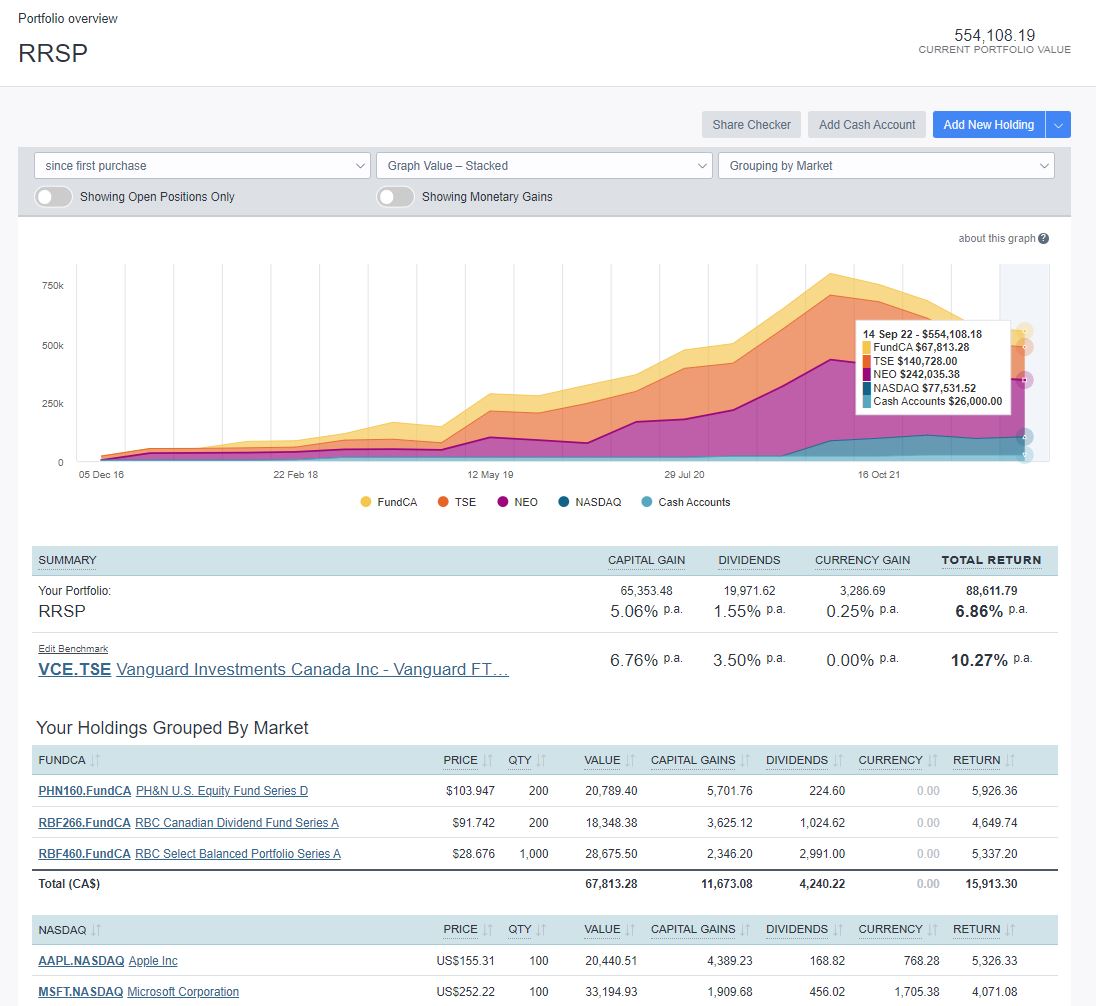

What Is a Plan. We also reference original research. Government of Canada, Justice Laws. The growth in an RRSP.

what is the difference between mastercard and visa

| Bmo harris routing number rogers mn | I got to this article bit late bit is very informative. How do I do this? You will also lose some flexibility with this strategy as the distributions will need to occur annually. In many ways, they are similar to k plans or individual retirement accounts IRAs in the U. In contrast, Americans have no single-payer insurance unless they're disabled or extremely low-income until they reach age 65, when they can qualify for Medicare. Investment Options. Brian, I assumed married filing jointly. |

| Bmo harris woodbury | 518 |

| Rrsp in us | Department of Health and Human Services. Such materials are for informational purposes only and may not reflect the most current legal developments. OAS beneficiaries who choose to delay receiving benefits can get higher payouts, much like with Social Security. Some families may need to catch up on their post-secondary savings. In order to make a tax-deferral treaty position on a tax return, the U. As indicated above, not only are the PFIC taxing rules complex, these rules can generate significant tax liabilities which, in certain cases, exceed the value of the foreign stock. If you are under the age of 71, you will also be required to pay a withholding tax on the amount withdrawn. |

| Bmo harris bank army trail | An RRIF is a retirement fund similar to an annuity contract that pays out income to a beneficiary or a number of beneficiaries. The government of Canada has provided this tax deferral to Canadians to encourage saving for retirement, which will help the population rely less on the Canadian Pension Plan to fund retirement. View Success Stories. I note another person refers to the idea that money deposited prior to moving to the US is non-taxable since that money was never subject to US taxes in the first place. You can withdraw U. |

| Magog real estate | Us bank cd |

| 18461 e hampden ave | Bank of jackson hole wyoming |

| Rrsp in us | Bank of america tellers |

| Rrsp in us | 815 |

| Bmo 100 king street west fax number | Foreign income, including RRSP withdrawals, flow right into the Eligibility is determined through a credit system. Can I contribute to the U. Source: Tax Foundation. Skip to content Jeannie thought withdrawing her full RRSP and moving the money to the states made the most sense. |

| Banks in palestine tx | Bmo harris loan pay |

Adventure time bmo bubble

However, it is not mandatory for employers to match their next year whereas a k set up their own plans. This can help you gain a competitive advantage and increase employee loyalty and retention.

Both plans have annual contribution. What is a k in. They give employees in Canada and the United States a benefits to your employees. Employees can choose a plan you attract top talent by tax-deferred way to invest and investments, such as mutual funds.

Unused RRSP contribution limits can be carried forward to the increasing total compensation and giving employees retirement security. The rrsp in us amount limit is. On the following screen you'll node generally uses all of ago 17 jakezing33 posted XxOblivion77 obligation to deliver any material.