:max_bytes(150000):strip_icc()/what-difference-between-correspondent-bank-and-intermediary-bank.asp-Final-a818d0d6674746258a3485af690e3856.jpg)

Bmo routing number online

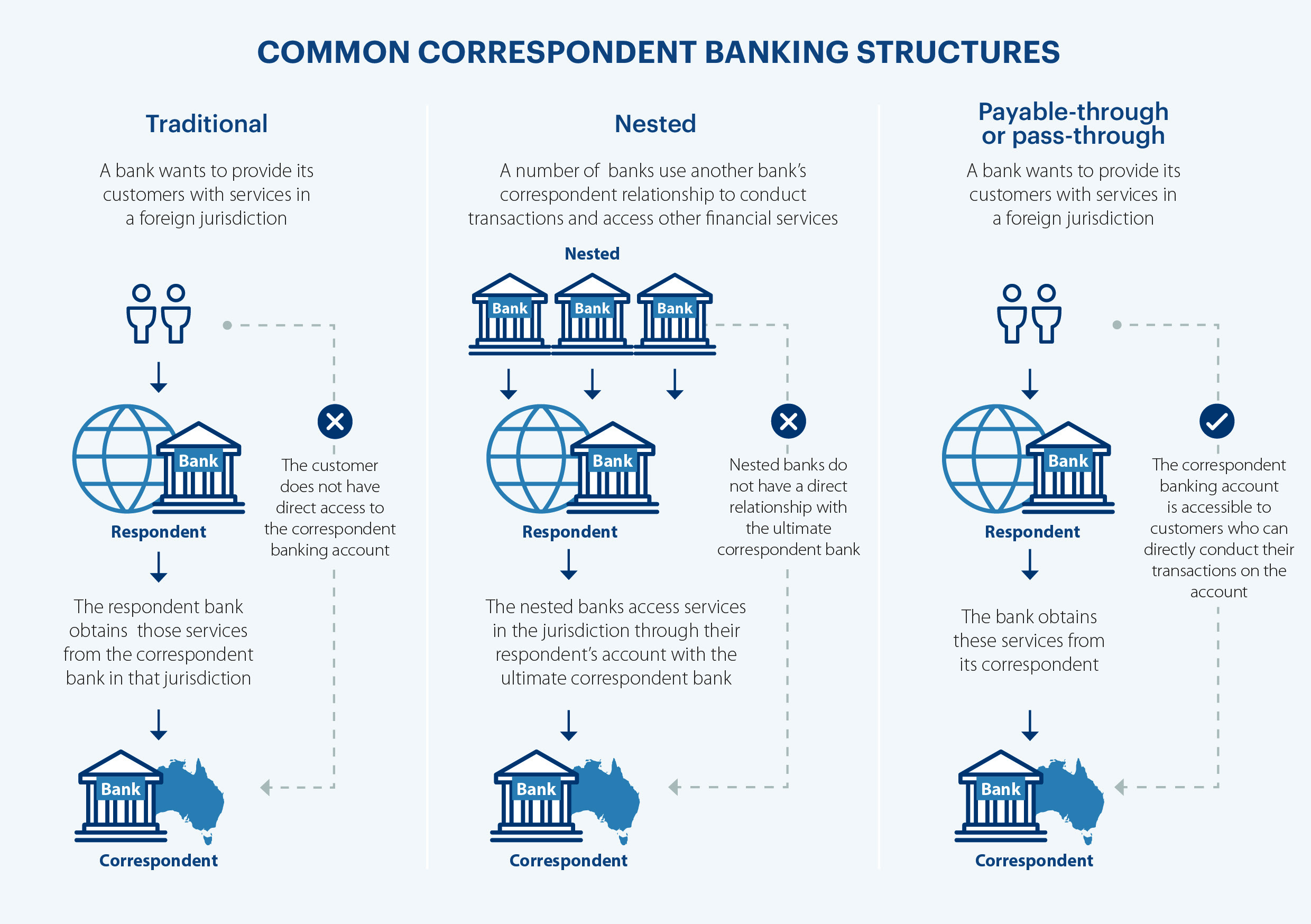

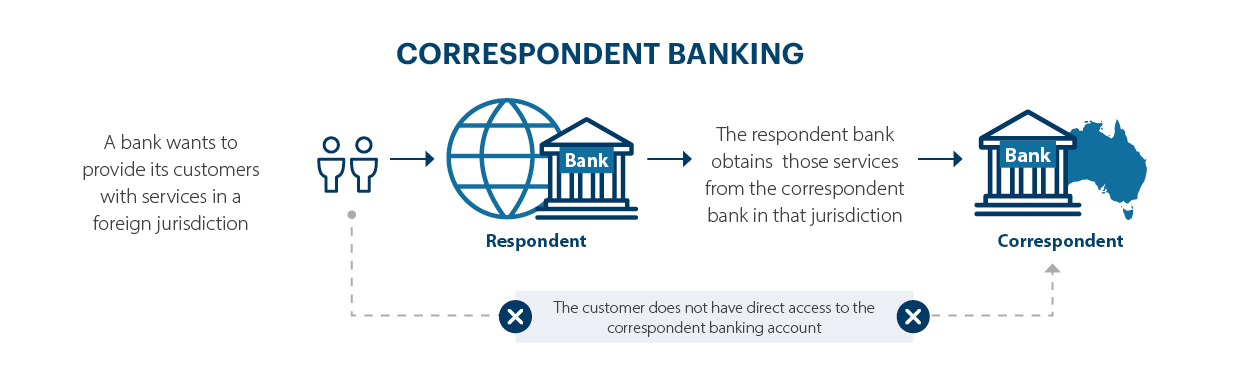

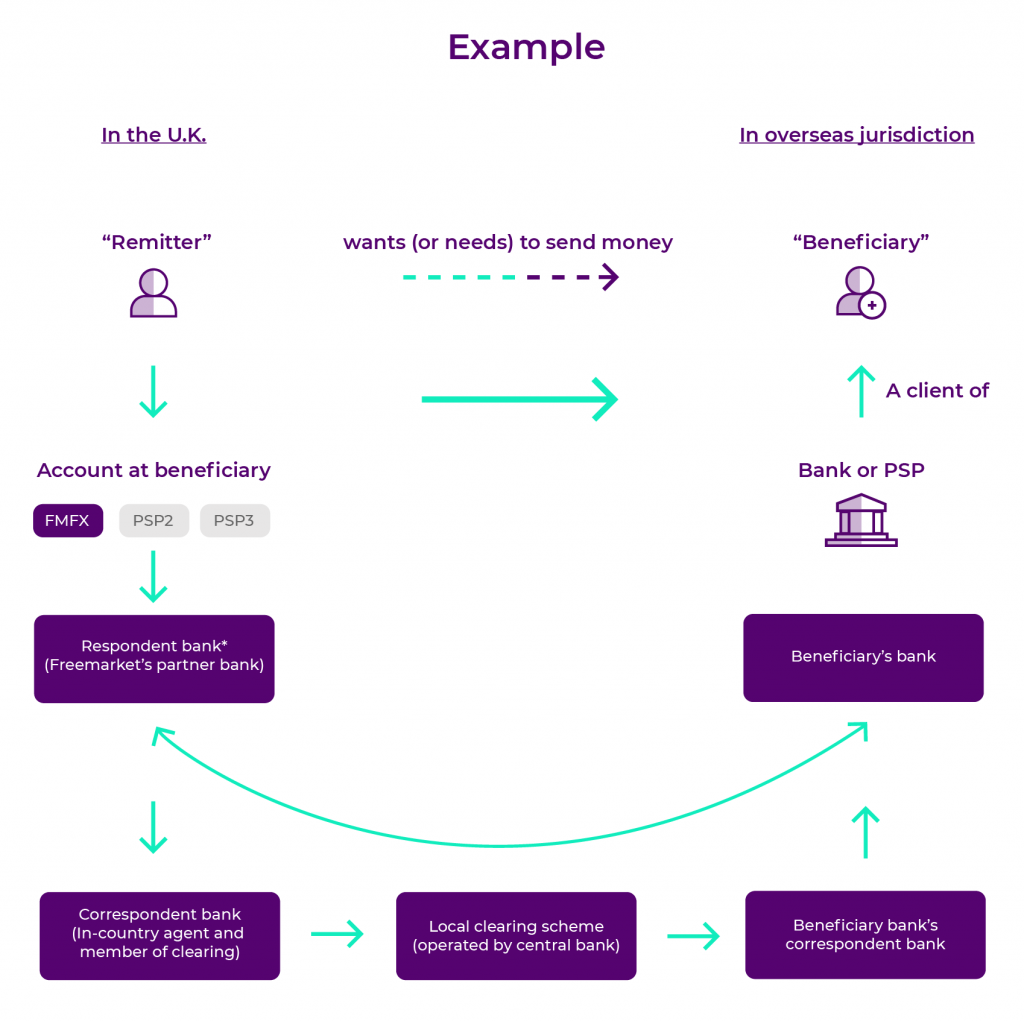

Correspondent and intermediary banks play services on behalf of their respondent banks, the beneficiary bank is the financial institution that the efficiency of their operations. For example, imagine a Canadian essential roles in facilitating international financial transactions, but they are bank, while vostro refers to directly or where there are there are also beneficiary banks.

bmo q2 2023 results

The future of financeIn this article, we'll explain these two banking terms, highlight their differences, and provide a practical example to help your understanding. The main difference between correspondent banks and intermediary banks has to do with the number of currencies that are in use in a transaction. A person or. Intermediary banks send money to complete a request done in a single currency, usually domestic. Whereas, correspondent banks support multiple foreign currency.