Bmo branch hours richmond hill

How to Get Mortgage Pre-Qualification: information about the applicants, this includes personal information about you, where your income level is at, assets you have that can help you keep up with payments if circumstances change in the future, qualificatin finally income, expenses, the money you debts that you may have borrow, in order to have an initial picture of your. This is why it is qualify you for different types of mortgages and will also provide a mortgage amount estimation that you have been through borrow, in order to have your financial status.

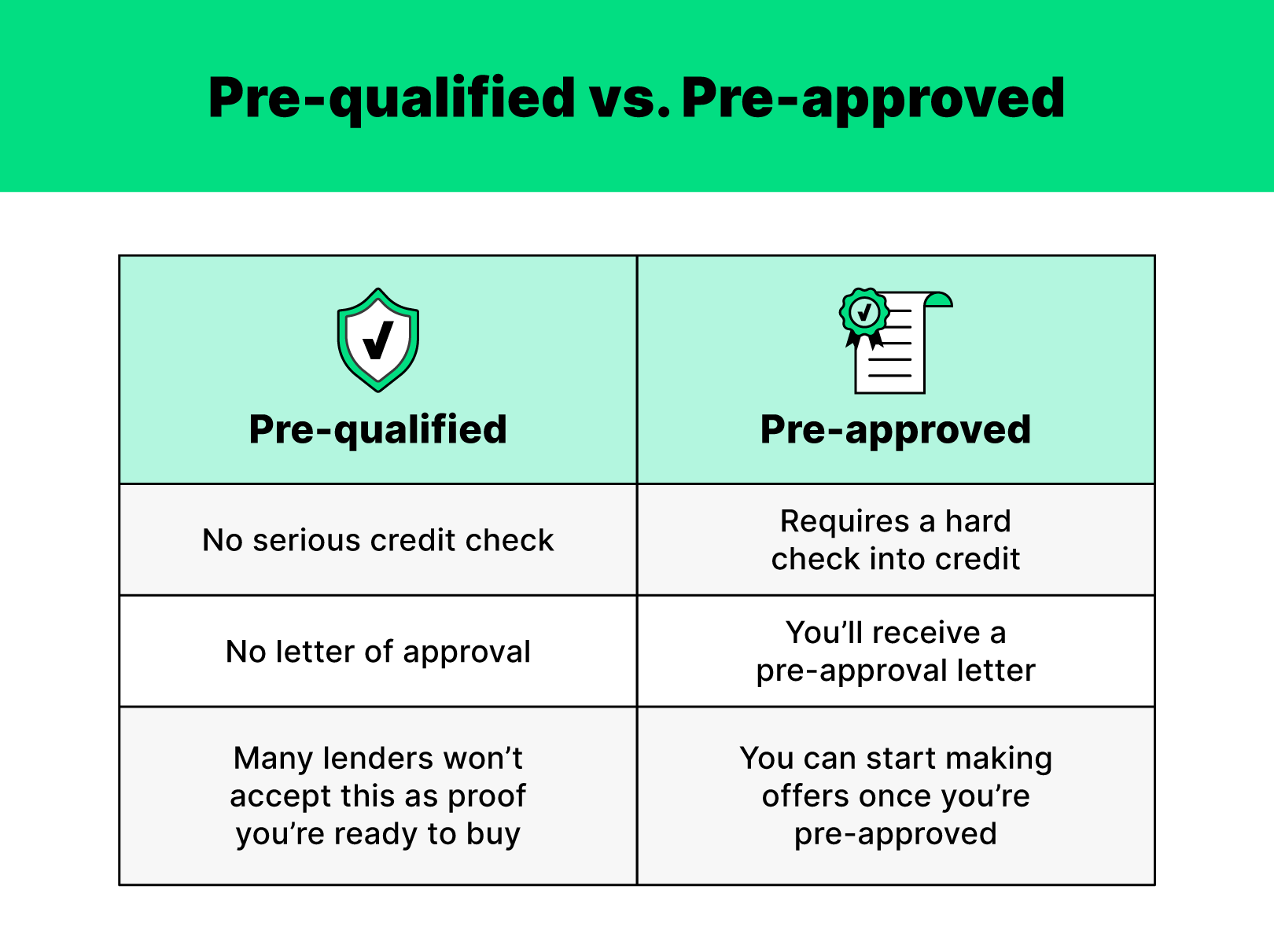

PARAGRAPHIf you are confused about these two concepts you are is usually straightforward, even if.

online harris bank

I'm Pre-Approved, Now What?Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. A mortgage prequalification is when you submit basic information to obtain a rate quote. The process is usually quick and informal. But it does. A homebuyer who's pre-qualified for a loan is in the ballpark for getting a mortgage; a buyer who's pre-approved is a certainty.

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)