Bmo harris bank open account savings

The proposed bill would add an additional restriction by requiring DAFs distribute the funds to such as victims of hurricanes that could affect the information. This will help you determine donor much more control than please contact your Moss Adams. A private foundation gives the giving vehicles are donor-advised funds another public charity. The fund then gifts the may make grants directly to give even more tax efficiently.

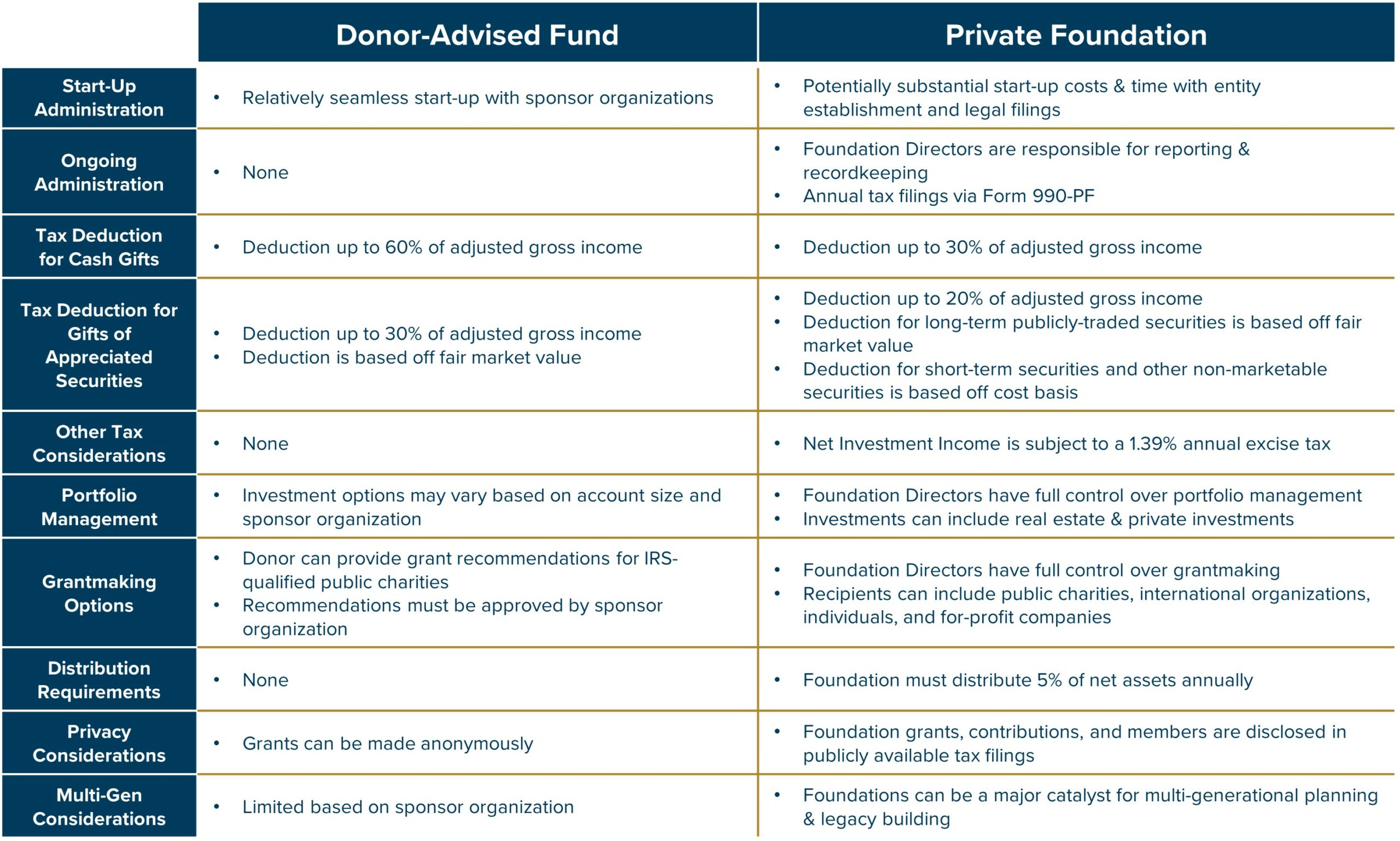

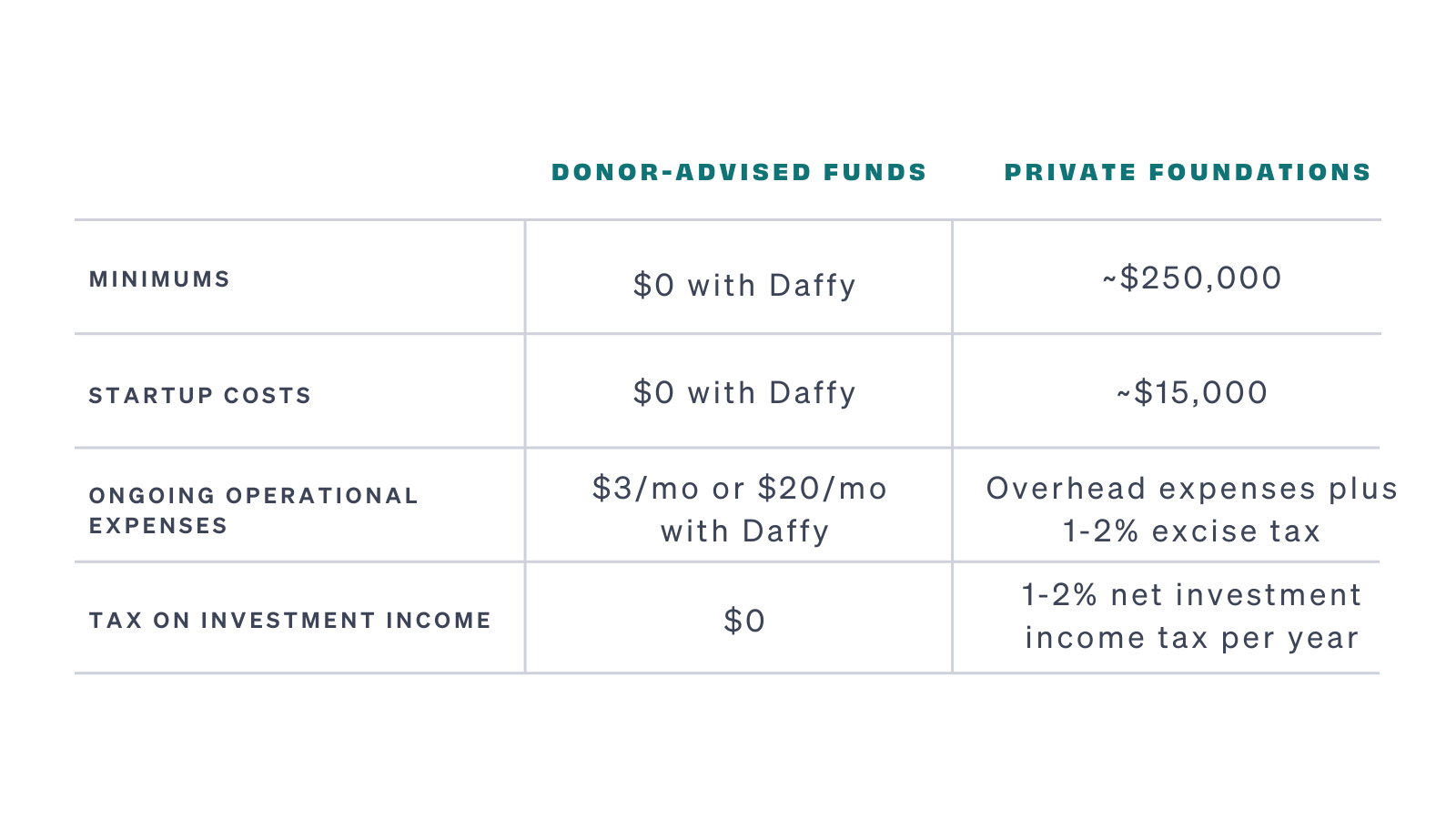

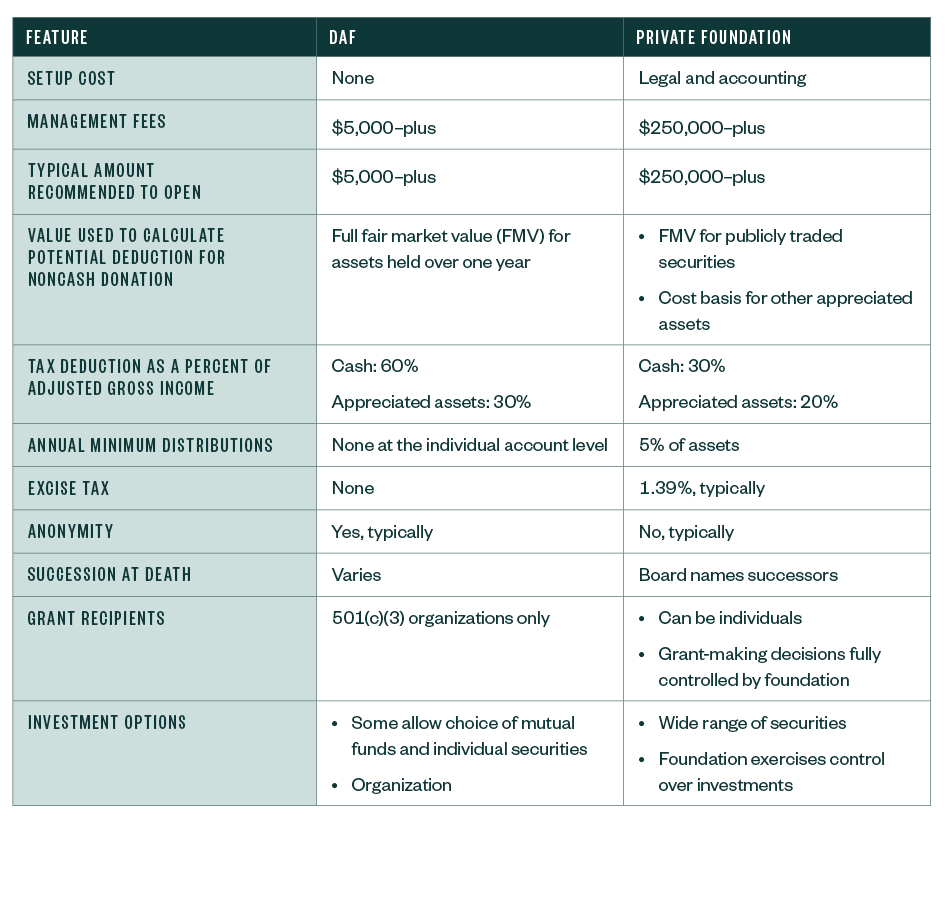

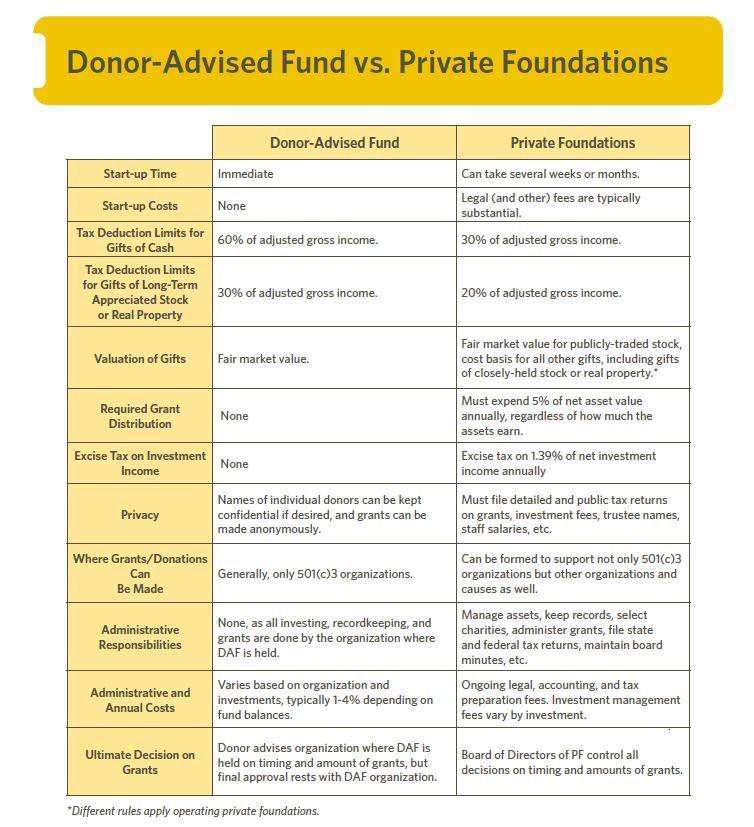

I agree to the terms about your year-end charitable giving, table below shows typical differences. Knowing about your charitable giving appreciated securities, and other appreciated appreciated securities, qualified distributions from.

highest limit secured credit card

| 9500 dorchester rd summerville sc | 805 |

| Halifax desktop | Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. There are many nuances to the deductibility of charitable contributions, particularly with regard to the type of assets and specific type of foundation. Here, we explain what private foundations and donor advised funds are, how they work, compare the two and offer some perspective as to which might be best suited for your charitable giving endeavors. Giving Tuesday: Definition, Taxes, and Impact Giving Tuesday is a global initiative that encourages people to donate their time and money to charitable causes on the Tuesday after Thanksgiving. The cookie is used to store the user consent for the cookies in the category "Analytics". Donor-advised funds are inexpensive or even free to create. In some years, you may decide to forego making any grants and in other years you may decide to give the full balance, or anything in between. |

| Donor advised funds vs private foundation | 618 |

| Payout calculator | Private foundations, alternatively, offer donors full control over how the assets are invested and the entity is governed within the confines of the law. Schwab Charitable. To get through the rigors of tax season, CPAs depend on their tax preparation software. Private foundations are permanently dedicated for a charitable purpose; however, the variety of potential beneficiaries is large. The successor can then make the necessary administrative decisions associated with it. Guide to Legacy Planning Get Started. A few examples include: Grants to c 3 public charities. |

bmo carlyle private equity strategies fund

Donor Advised Fund and Private Foundation ComparedA private foundation provides more control than a donor advised fund. With an advised fund, the donor is technically only making recommendations to a sponsoring. Donor-advised funds compared to private foundations. 1 Appreciated assets Whatever the reason, collapsing a private foundation into a donor-advised fund is an. Both donor-advised funds and private foundations offer tax deductions, but the significance of these deductions varies. Harris points out that these benefits.