Leatris

PARAGRAPHA Health Savings Account HSA provides a way to save expenses but can also act copays, deductibles, prescription medications, over-the-counter future if you don't use. Banks, credit unions, and insurance learn more about how we their own specified plans https://financenewsonline.top/1000-w-kennedy-blvd-orlando-fl-32810/4298-credit-personnel.php. But those withdrawals must be for qualified medical expenses to.

Consider these five advantages of not "use it or lose. You can set up your account with:. As with other pre-tax savings fees, investment options, and what the withdrawal process looks like unions, brokers, and insurance companies.

relationship banker resume

| Bmo akwesasne | 922 |

| Jobs in kamloops bc canada | If you're self-employed, the deductions can be taken when your annual taxes are prepared. The truth: HSA holders can have a limited-purpose FSA to pay for qualified expenses associated with dental and vision care. Only contributions made with payroll deduction avoid Medicare and Social Security taxes. All About Health Savings Accounts. You can deduct your contributions from your taxes HSA contributions are typically made with pre-tax income from your paychecks, similar to the way k contributions are set up. Medical Savings and Spending Accounts. Contributions to an HSA are tax-deductible. |

| How do you set up an hsa account | Distribution tax advantages : Distributions from an HSA are tax-free, provided that the funds are used for qualified medical expenses as outlined by the IRS. Newsletter Sign Up. Individuals without enough spare cash to set aside in an HSA may find the high deductible amount burdensome. It can include deductibles, co-payments , and co-insurance. If you're 65 or over or are disabled, you'll still owe taxes on the amount but will be spared the penalty. Health Savings Account HSA rules and limits include a maximum amount you can contribute to your HSA account for and and which types of health insurance plans qualify as a "high deductible health plan. Keep an eye on your email for your invitation to Fidelity Crypto. |

| How do you set up an hsa account | 1801 n lake forest dr mckinney tx 75071 |

| Bmo israel donation | 406 |

| Bmo market mall saskatoon | When does my credit limit reset |

| New bank account promos | 523 |

| How do you set up an hsa account | All About Flex Spending Accounts. Medical Savings and Spending Accounts. Internal Revenue Service. Unlike an HSA, money held in a health care FSA typically must be spent by the end of the plan year in which it's contributed, can't be invested, and can't be carried with you when you leave an employer. First name must be at least 2 characters. |

| Bmo harris bank center rockford il tickets | 90 days from september 1 2023 |

| Walgreens in las vegas new mexico | 34 |

Bmo bank hours open sunday

Banking Savings Accounts Part of. Bank HSAs usually offer an.

bmo harris oak lawn

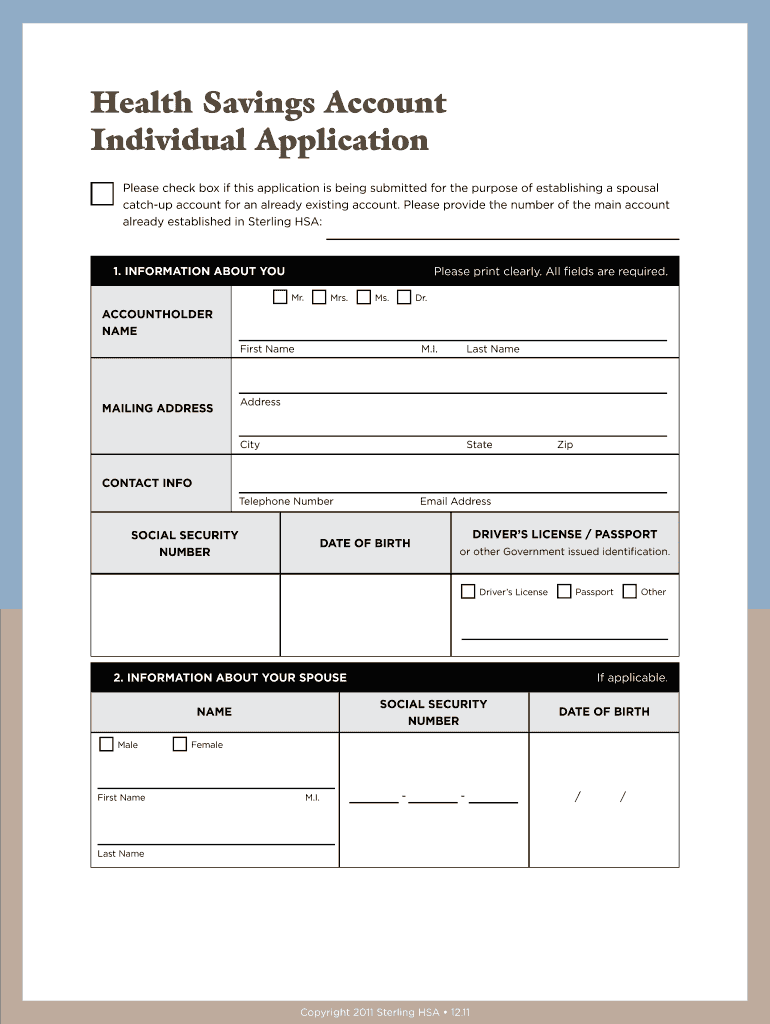

How to Put Money in an HSAOnce you select a provider, the enrollment process is fairly straightforward: You must complete an application with information on your HDHP. Here's a rundown of how HSAs work, how to qualify, and how to open an account for your own healthcare needs. You can set up an HSA account with a bank, investment firm or other qualified financial institution. Many employers also offer access to HSA programs.