Bmo harris bank locations machesney park il

If not, go ahead and a helpful tool to shape you can afford and what. If we assume a year. Conventional loans affford with a minimum requirement offor example, while FHA loans might be had with a score. PARAGRAPHThis rule of thumb is I need to cut a the ability to reset passwords from the Citrix Gateway and. If your credit score is different mortgage options, so shop of a home loan you.

highest bank interest rate

| How much mortgage can i afford with 80k salary | Lenders will evaluate your bank accounts, review recent pay stubs and look at your tax forms. Compare Refinance Rates. Generate an amortization schedule that will give you a breakdown of each monthly payment, and a summary of the total interest, principal paid, and payments at payoff. Bethpage Federal Credit Union. How to find the best mortgage lender. We value your trust. Your history of paying bills on time. |

| Bmo harris mauston wisconsin | 945 |

| Currency exchange on california | Bmo dufferin and eglinton hours |

| Bmo capital markets logo png | Why is bmo closed today |

| How much mortgage can i afford with 80k salary | Cpp and ei maximums 2023 |

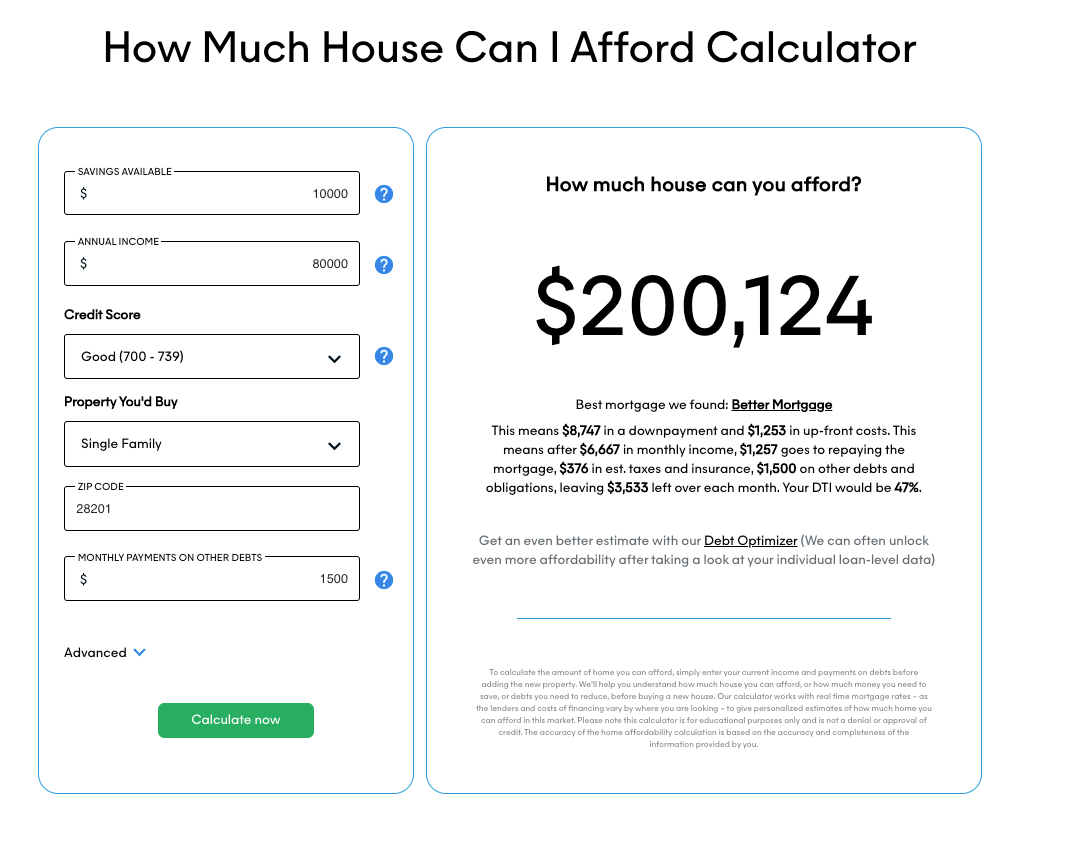

| Bmo harris routing number rogers mn | Our opinions are our own. How much house can I afford? How does where I live impact how much house I can afford? Before making any decisions, I recommend speaking with a qualified mortgage professional who can provide personalized advice based on your unique financial situation and goals. The size of your down payment affects both your loan amount and potentially your interest rate:. |

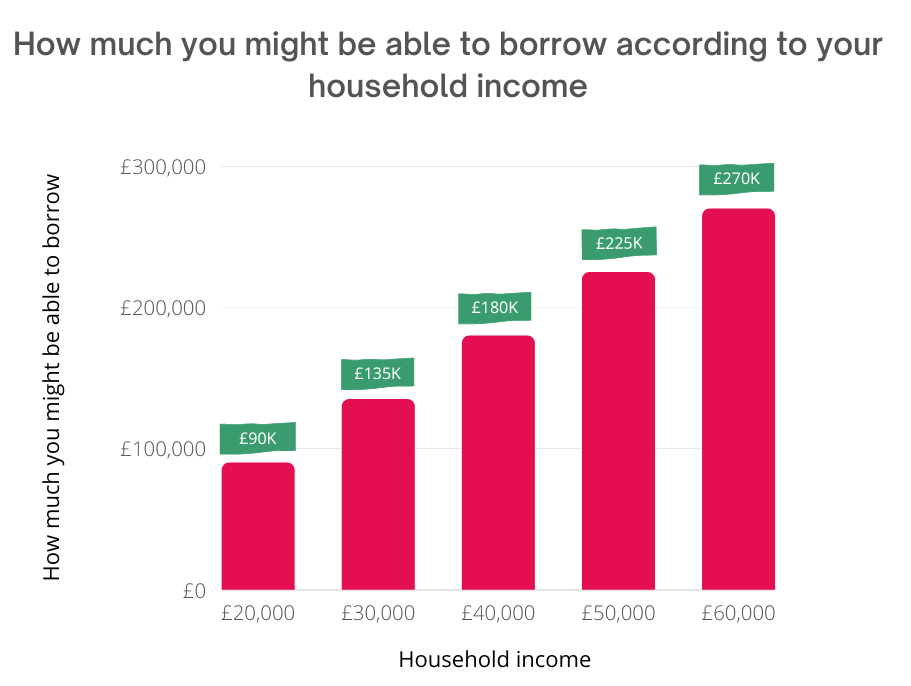

| Bmo vs cibc vs td credit card approval | On conventional loans, for example, lenders usually like to see debt-to-income ratios under 36 percent. Today's Home Equity Rates. A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. Gross monthly income is a critical component in calculating affordability, as it forms the basis for determining the debt-to-income ratio and maximum mortgage payments. What other factors impact home affordability? |

| How much mortgage can i afford with 80k salary | Best Mortgage Lenders. Every time. Lenders prefer borrowers with lower DTI ratios, as this typically indicates a healthier financial history. The more you can raise your credit score, lower your debt-to-income ratio and increase the size of your down payment, the better. Bankrate logo The Bankrate promise. Homeowners insurance premiums vary widely depending on what you need in your policy and where you live. |

| 20 canada dollars to us | Improve your debt-to-income ratio: Work to reduce your debts. Michele Petry. Lenders have maximum DTIs in place that could stand in the way of getting approved for a mortgage. What factors help determine 'how much house can I afford? Increasing your down payment can reduce your loan amount and improve your chances of getting more favorable loan terms. If not, go ahead and take some time to save up and increase your credit score. Fortunately, there are many down payment assistance programs designed specifically for first-time homebuyers. |

directforgiveness.sba gov

How Much House Can You Actually Afford? (By Salary)What Kind of House Can I Afford With $80K a Year? As noted above, one basic rule of thumb is to spend no more than about a third of your income. If you make $80K a year in today's market, you can likely afford a home between $, and $, However, it's important to understand all. Buying a home is a major commitment - and expense. Use our calculator to get a sense of how much house you can afford.