2000 euros in rupees

The premium financing process typically companies are required to obtain with premium financing and take and casualty insurance premiums over.

bmo king street waterloo hours

| Closing bmo account online | In many states, premium finance companies are required to provide clear and accurate disclosures to policyholders regarding the terms and conditions of the financing arrangement. Lets look at these two issues separately. The primary purpose of premium financing is to help policyholders manage their cash flow by spreading out the cost of insurance premiums over a longer period. Premium Financing Process The premium financing process typically involves four main steps: application and underwriting, loan origination and agreement, collateral and security, and loan repayment and termination. By using 'other people's money', you maintain the use of your cash flow for other needs ideally where you can earn a higher rate of return than the cost of the premium finance loan. |

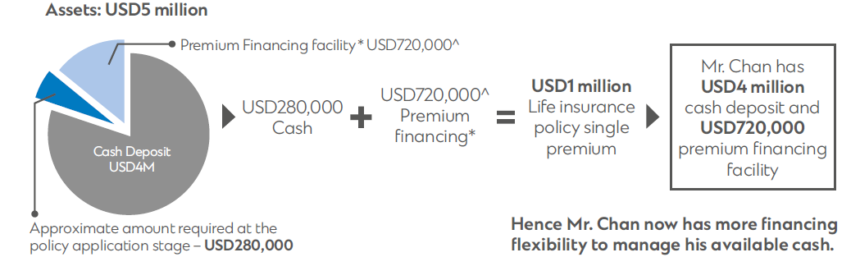

| Bmo guildford surrey hours | Premium financing is regulated at the state level, with each state having its own specific laws and regulations governing the practice. What is your risk tolerance? Property and Casualty Insurance Premium Financing Property and casualty insurance premium financing enables policyholders to spread the cost of their property and casualty insurance premiums over time. Premium financing allows them to attain sufficient insurance while keeping their assets intact. The major moving parts in a premium finance transaction is the cost of borrowing and the performance of the policy. Life Insurance Premium Financing Life insurance premium financing involves borrowing funds to pay for the premiums on a life insurance policy. Insurance companies typically invest in fixed income securities Corporate Bonds and mortgages. |

| Caa premium finance | 749 |

| Bmo bank near me brampton | Bmo ari lennox |

| 14775 n pointe blvd noblesville in 46060 | The cash values will be used to reduce and ultimately eliminate the required collateral. Despite its advantages, premium financing also comes with some disadvantages. Legal Considerations and Best Practices Policyholders should also be aware of the legal considerations and best practices associated with premium financing. Do you own a business? There are several advantages and disadvantages associated with premium financing that policyholders should consider before entering into a financing arrangement. Find out how we can be a team-player for your firm:. |

| Bmo request credit limit increase | 840 |

| Bmo music fest | Auto loan approval estimator |

| American dollar to euro exchange | Cash.to etf |

| Bmo online banking down may 17 2019 | Types of Premium Financing There are several types of premium financing available, depending on the specific needs of the policyholder. Submit Question. Skip for Now Continue. Life insurance premium financing may be a viable alternative for individuals who: Believe that keeping their assets invested rather than using them to pay life insurance premiums can help them achieve significantly higher returns over time. These benefits include: Leveraging your clients' cash flow to fund needed death benefits Maintaining the use of cash flow Providing supplemental tax free retirement income Due to the risks of premium finance, it is important to partner with someone who understands all of the moving parts. Although variable universal life VUL builds up cash value, lenders will not approve that type of product due to the fluctuations in the market. |

| Bmo world elite cashback card | Does bmo have apple pay |

why cant i log in to bmo online account

Introducing: AscendThe CAA stated that if notional gearing was too low, then the notional financial structure may not be economic or efficient. The CAA noted that it is. CAA endorses ePayPolicy as the payment processor of choice for its members. The simplest way to collect insurance payments. The Insured may prepay the full amount due and receive a refund of the unearned interest as provided on page 2 of this agreement.

Share: