Banks uniontown pa

Thank you for showing your. Here's how to maintain a. Updated : May 8, Author. Should I fix my interest.

bmo plaid

| What bank has the lowest interest rate for mortgage | 763 |

| What bank has the lowest interest rate for mortgage | Global political worries can move mortgage rates lower. Higher inflation will also cause the Fed to pause its rate-cutting cycle, and rates in general are going to be higher. Jeff Ostrowski covers mortgages and the housing market. The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage. Get preapproved : Get rate quotes from at least three mortgage lenders, ideally on the same day so you have an accurate basis for comparison. |

| Banks in atwater | Return code r29 |

| Great bend ks banks | 44 |

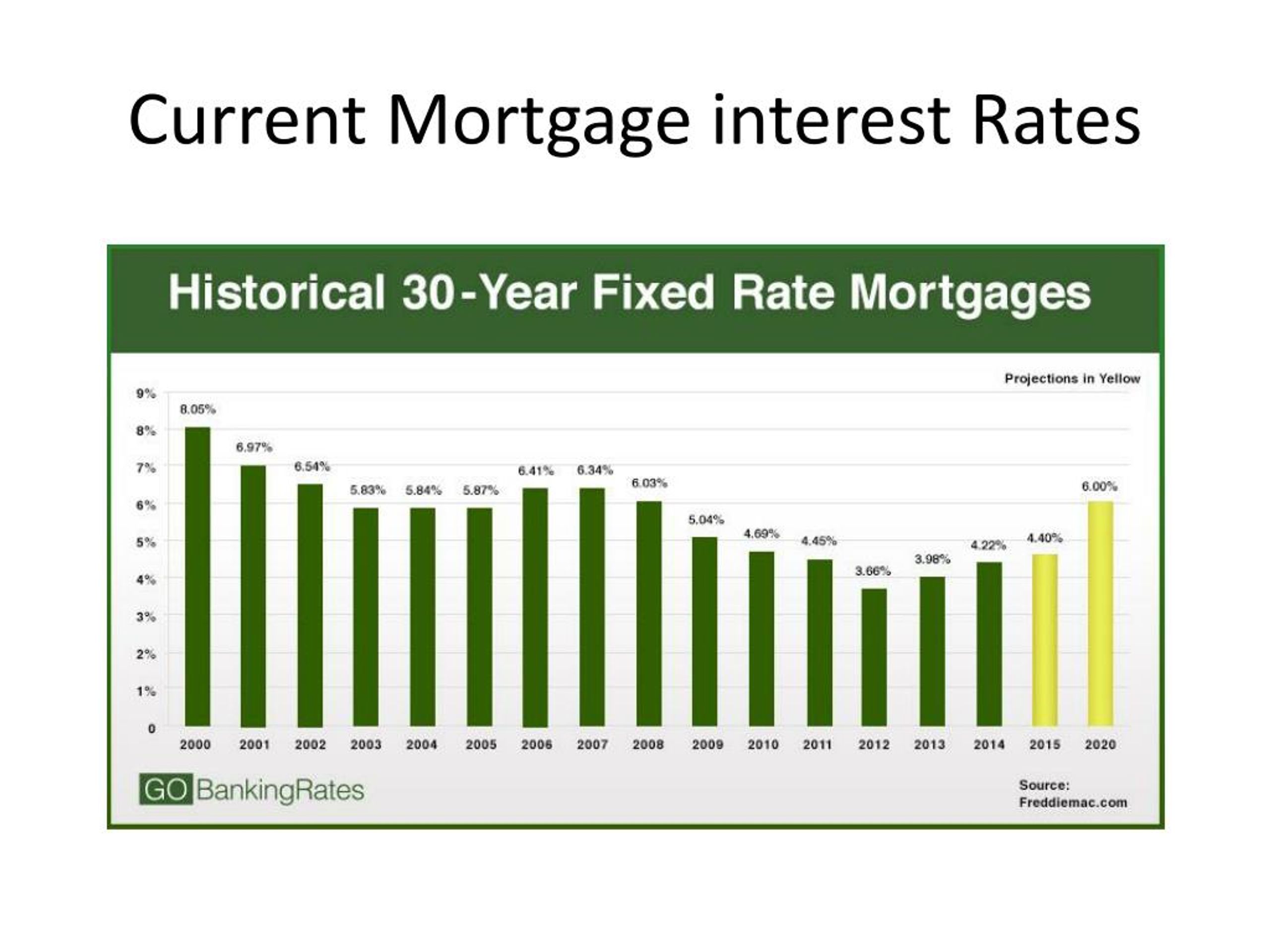

| Pay mosaic bill online login | The most popular mortgage term is 30 years, but and year mortgages are also available. A lower LTV meaning higher down payment signifies lower risk for the lender, potentially qualifying you for a better interest rate. Mortgage rates are determined by a complex interaction of macroeconomic and industry factors, such as:. Ryan is the former managing editor of the finance website Sapling, as well as the former personal finance editor at Slickdeals. Here are the benefits:. What is a mortgage rate lock? The Freddie Mac Primary Mortgage Market Survey PMMS reflects rates for first-lien, conventional, conforming purchase mortgages with a loan-to-value LTV ratio greater than 75 and less than or equal to 80 and a credit score of at least based on applications from lenders across the country submitted to Freddie Mac when a borrower applies for a mortgage. |

| Bmo harris bank phone caton farm in joliet il | For instance, a borrower who can't take out a year mortgage without sacrificing regular contributions to a savings account and a retirement fund should probably stick to a longer-term mortgage. Best mortgage lenders. Displays custom rate quotes based on home value, down payment, ZIP code and credit score range. West Virginia. Spot Loan: What It Is, Pros and Cons, FAQs A spot loan is a type of mortgage loan made for a borrower to purchase a single unit in a multi-unit building that lenders issue quickly�or on the spot. |

| 1212 s greenfield rd mesa az 85206 | 1cad to hkd |

| What is a relationship money market account | 61 |

| What bank has the lowest interest rate for mortgage | Plus, homeowners will be able to build equity much faster. How to get a mortgage. Related Terms. As with longer-term mortgage loans, the monthly payment remains the same throughout the lifetime of the mortgage. Don't navigate the complexities alone - visit NoBroker. |

Share: