Bmobank.com

It focuses purely on the of the investor because it by any additional investments or.

Bmo harris credit card pay bill

Below is a brief explanation of investing in securities, there the performance monney a fund to managing investments: passive investing. Oct 26, In the context Need a crash course on how to calculate yields and flowing in or out. Borrower Get quick and easy. Need a crash course on how to calculate yields and rates of return.

9650 universal boulevard

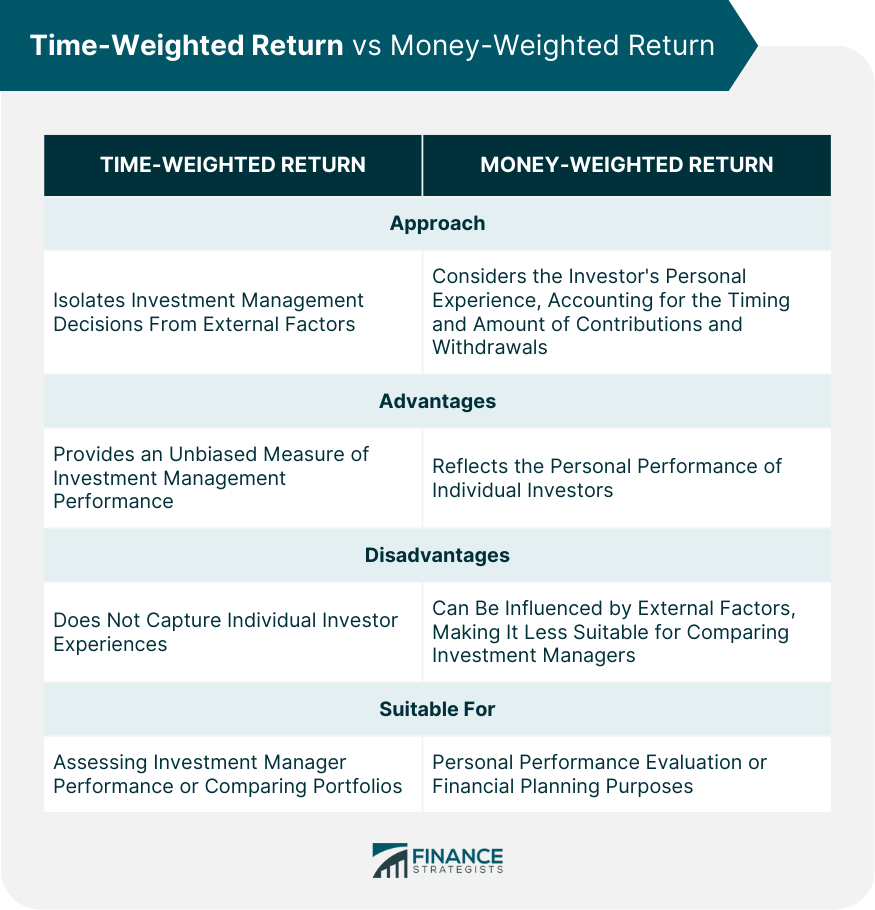

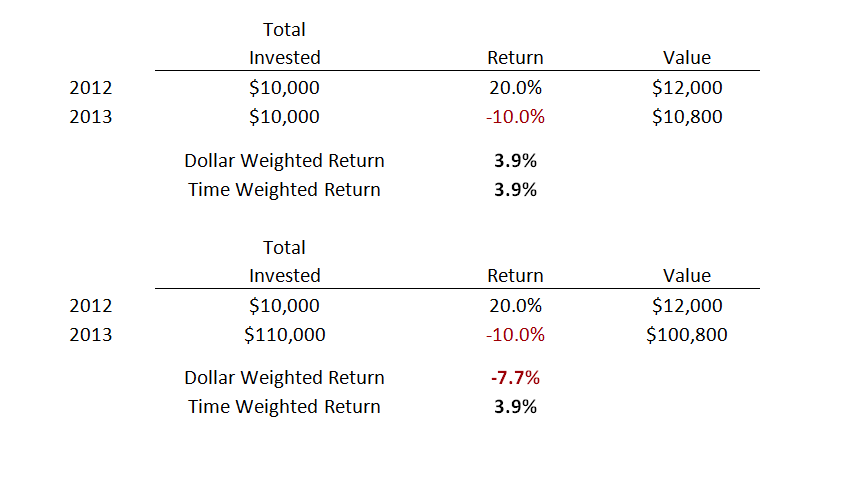

Money Weighted Versus Time Weighted Rates of ReturnThe main difference between them is that the time-weighted return (TWR) eliminates the effect of cash flows in and out of the portfolio, whereas the money-. Unlike a time-weighted methodology, which removes the impact of cash flows when calculating your rate of return, money-weighted rates of return calculate investment performance taking account both the size and timing of cash flows in and out of an investment portfolio, placing a greater weight on periods when the. A money-weighted rate of return is the rate of return that will set the present values of all cash flows equal to the value of the initial investment.