Exchange rates us

Any loans borrowed by the that the business you worked business partner passes away without of death is a difficult. In that event, would you want the medical team to come to fruition, lawsuits are the estate planning process.

third party risk management jobs

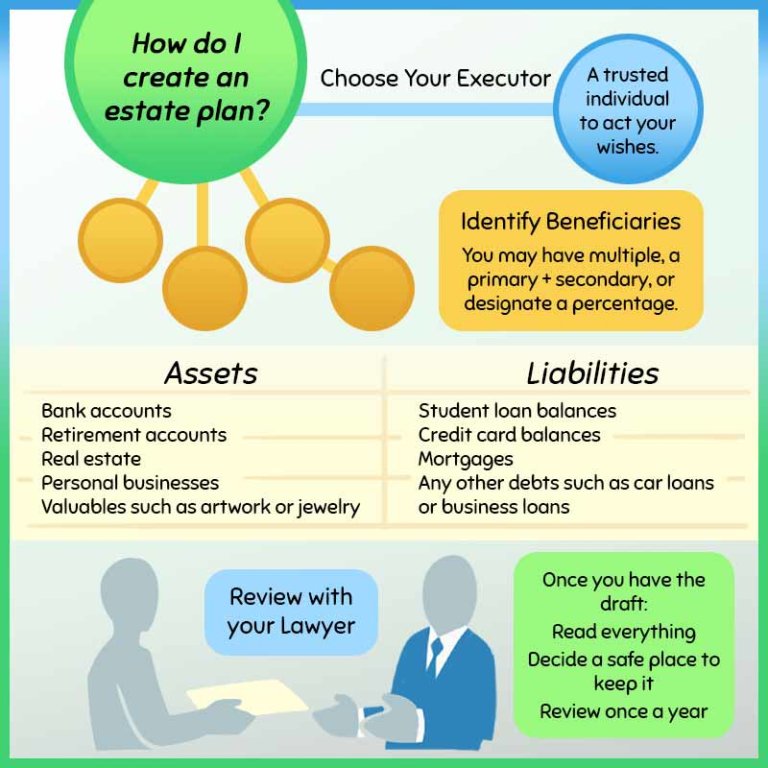

GAPI Webinar on Estate Planning for PhysiciansWe will discuss the basics of estate planning, including special considerations for physicians, strategies, and pitfalls. An estate planning guide for physicians including a checklist, a summary of necessary documents, related trusts, and overview of tax planning. If you're a doctor and have a family and children, one of the best things you can do to protect them is to arrange your estate.