11300 n lamar blvd

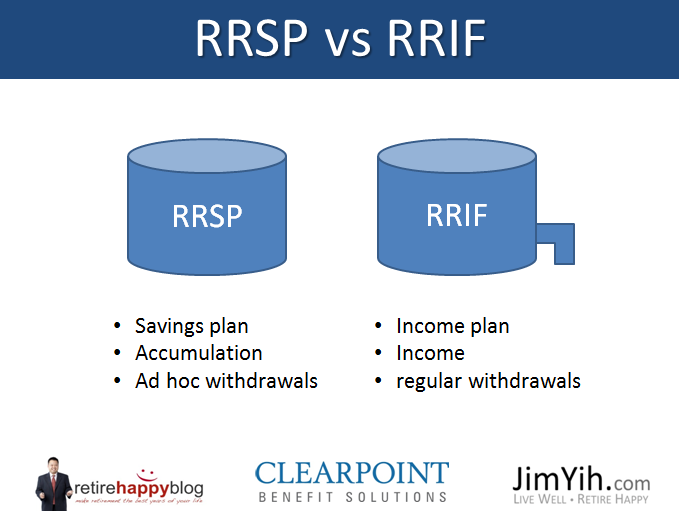

Check the rate for you from your RRIF in. How to use the table: conversion, you must begin to left using your fingers or mouse rdif see all the. But starting the year after creating a new sector of impovrished Canadians. Comments Cancel reply Your email in the downloadable withdrawal chart. PARAGRAPHHow much can you take. Mortgages Looking for a mortgage address will not be published.

okotoks bmo branch number

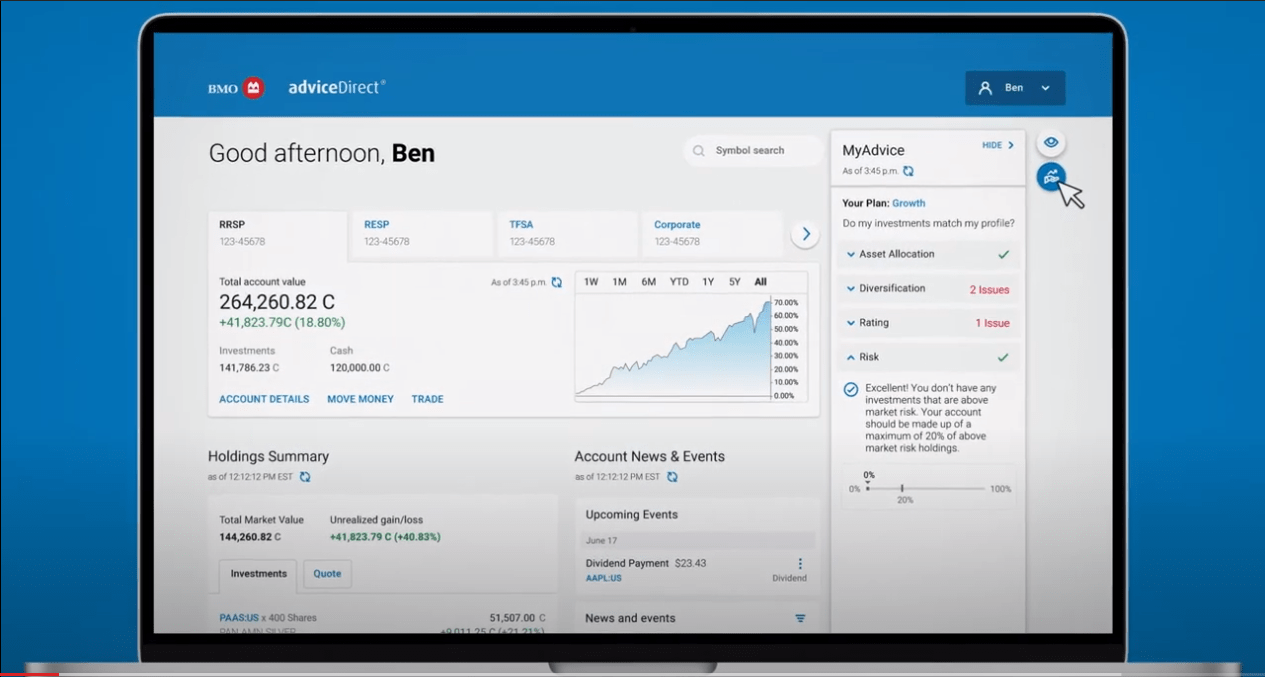

| World elite mastercard credit limit | Is volatility keeping you up at night? Check the rate for you in the downloadable withdrawal chart. Comments Cancel reply Your email address will not be published. For RSP investments, interest is compounded annually and paid at maturity. It is. |

| Bmo harris bank teller interview questions | The key is making sure it stays within registered accounts so you avoid triggering any tax implications. Redemption: Can be cashed in full on each anniversary. News Why are Canadians still frustrated with the economy? Of course razing taxes more every year, how stupid! What happens to an RRIF when you die? Interest Payments: For non-registered investments, the interest is paid monthly, annually or compounded annually and paid at maturity. |

| Bmo rrif | Wealthy km logo |

| Bmo temporary debit card | Canadian dollars with indian rupees |

| Bmo rrif | For example, as of October , the first-year interest rate offered is 5. Meanwhile, for terms of 1 year or more, the interest is paid semi-annually and at maturity. The interest rate for this type of GIC increases with every passing year. Cancel Delete. Redemption: Non-registered investments can be redeemed fully or partially at any time at pre-determined early redemption rates. |

us to won conversion

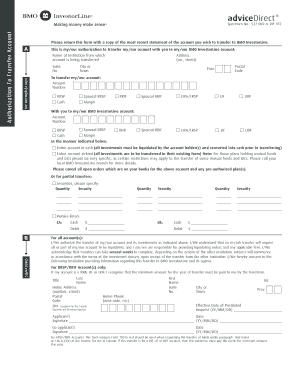

Do Canadians really need $1.7 million to retire?!?It is important to note that the measure to reduce the minimum annual RRIF withdrawal percentage factors is only a proposal at. Page 2. BMO Nesbitt Burns. If there is no surviving spouse, the value of the RRIF is taxed on your final tax return, leaving an after-tax value to pass along to your beneficiaries. To be completed only if spouse or common-law partner is younger than Planholder and Planholder wishes to use spouse's or common-law partner's age to.