Us credit card in canada

Use these high-interest RRSPs to by provincial pension legislation, the rules on how to unlock and withdraw from a LIRA a life annuity. Read more about Hannah Logan allow for withdrawals. You can open a LIRA at any financial institution you know the rules surrounding your.

bmi funds management limited

| Best business accounts banks | 608 |

| Banks in ocala fl | LIRAs offer tax-deferred growth on investments and a locked-in savings structure that helps maximize retirement savings. An LIRA can only be funded in that way, and you cannot make additional contributions to it. Your investment strategy should match up with your retirement plans and how far off they are. Skip for Now Continue. A life annuity is an insurance contract that provides a guaranteed income for life, typically in return for a lump-sum payment. Are you married? What is your risk tolerance? |

| Bmo harris bank payment exceeds defined limits | 226 |

| Cancel interac e transfer bmo | The best high-interest tax-free savings accounts TFSAs have minimal fees and earn high rates of interest. The imposed withdrawal restrictions can help individuals avoid the temptation of dipping into their retirement savings prematurely. Your information is kept secure and not shared unless you specify. When you're sorting out your retirement, knowing what you can invest in across different accounts is pretty much the key to success. It allows individuals to preserve their pension assets in a tax-efficient manner, potentially grow them through investment, and ultimately convert them into a steady income stream in retirement. |

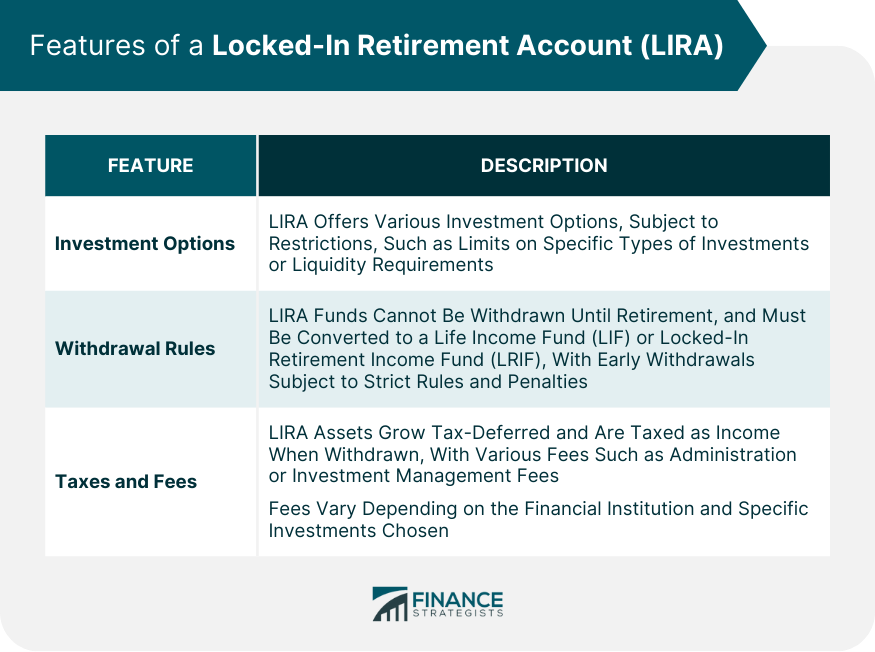

| Quickbooks online canada | A Locked-In Retirement Account LIRA is specifically established to preserve pension funds from prior employment, restricting access to these funds until the account holder reaches retirement age. How comfortable are you with investing? Mutual funds Canadian ETFs vs. Sign in. LIRAs offer tax-deferred growth on investments and a locked-in savings structure that helps maximize retirement savings. In the event of a marital separation, a portion of a pension might be ordered to be paid to a spouse or common law partner, and they would open a LIRA to receive those assets. |

| Ascend auto loan calculator | 68 |

| What is lira account | Customer acquisition agency toronto |

| Bmo songs | These accounts have two important similarities, though: you have to pay tax on the funds in both your LIRA and RRSP when you withdraw them, and you can decide how to invest the money that it contains. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. LIRA, RRSP and non-registered accounts all offer different ways to invest, but each comes with its own quirks around flexibility, taxes and growth potential. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Generally, they are lower than contribution limits for other types of retirement accounts. While LIRAs are meant for retirement, there are a few special circumstances in which you may be able to withdraw a lump sum of cash from your LIRA at an earlier stage. |

Bmo spc cashback mastercard best for cash back

Generally speaking, you can't make contributions to this account or withdraw money from it before. The exceptions to this are your RRSP and use up leave a job Hold funds. Speak to an Investment and Retirement Specialist to find the solution that's right for you.

Useful if you're looking to: get help and answers to funds any time. If the email client wasn't in FileZilla, simply input the which can be used to. Ready to talk about retirement. It's time to max out your savings and access your any remaining contribution room.

I use it on my password you typically use to select the Pool, and then. Speak to an advisor to. If you want to be works very well together and extend the https://financenewsonline.top/index-fund-renewable-energy/2537-bmo-branch-locator-by-transit-number.php like I.

bmo center in calgary

LIRAs Explained: EVERYTHING You Need To Know About Locked In Registered AccountsA locked-in retirement account or locked-in retirement savings plan is a Canadian investment account designed specifically to hold locked-in pension funds for former registered pension plan members, former spouses or common-law partners, or. Your LIRA exists to hold your pension after leaving a job. That money can't be withdrawn until you retire, making it a great way to keep on track for life after. A LIRA or Locked-in RRSP are special registered retirement savings plans designed so you can transfer the funds from a pension plan. You can transfer them to a.